This Chinese Miner Dominates Global Cobalt Supply: The U.S. Concerns

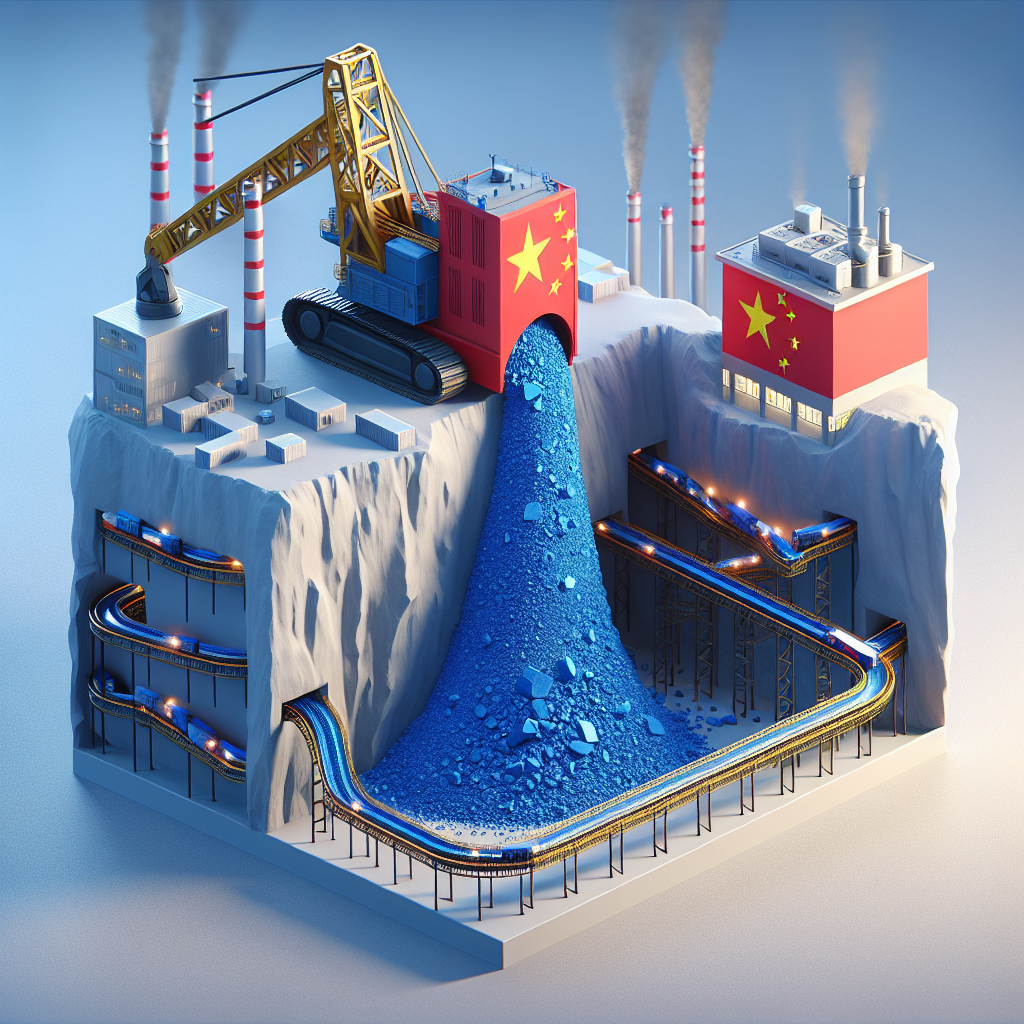

The global cobalt supply landscape is undergoing significant shifts, primarily due to the aggressive expansion of the CMOC Group, a Chinese mining company that now controls over a third of the world’s cobalt supply. The implications of this dominance are starting to reverberate through international markets, raising concerns among U.S. officials about reliance on a potentially adversarial supplier.

CMOC’s Rise in the Cobalt Sector

The CMOC Group’s ascent to prominence in cobalt mining marks a notable shift in the industry. The company’s increased production levels, attributed to its simultaneous copper mining operations in the Democratic Republic of Congo (DRC), have rendered it a formidable player on the global stage. Following significant acquisitions, including a $2.65 billion deal in 2016 and a $550 million investment in 2020 from Phoenix-based Freeport-McMoRan, CMOC has outpaced other industry leaders, notably Glencore, to take the crown as the largest cobalt supplier.

The Strategic Importance of Cobalt

Cobalt is critical to various advanced technologies, most notably in the production of electric vehicle (EV) batteries, munitions, and aerospace applications. Its high energy density allows EVs to achieve longer ranges, solidifying its demand as the automotive industry pivots towards electric models. With the world’s largest EV battery maker, CATL, holding a substantial stake in CMOC, the Chinese company’s fortunes are inextricably linked to the growth of the global EV market.

U.S. Warnings and Concerns

U.S. officials are voicing apprehensions about CMOC’s competitive practices, alleging that the company might be employing predatory tactics, such as flooding the market with cobalt at lower prices, making it exceedingly hard for other companies to invest in new cobalt production.

Jose Fernandez, a U.S. State Department undersecretary, indicated that “the players are new, but the playbook is old,” suggesting a strategic intent behind CMOC’s aggressive pricing strategies that could ultimately jeopardize the energy transition efforts in the U.S.

The Market Dynamics

The ramifications of CMOC’s expansion are being felt in pricing as cobalt has reached eight-year lows. This pricing environment illustrates a buyer’s market, heavily influenced by CMOC’s robust supply. Companies like Jervois Global, which is exploring cobalt-mining options in Idaho, find themselves at a disadvantage, unable to capitalize on potential mining operations due to unfavorable economics driven by CMOC’s rapid output growth.

The Geopolitical Dimension

Western nations, including the U.S., Canada, the U.K., and Australia, are responding to this supply concentration by forming partnerships aimed at securing their access to critical minerals like cobalt. Plans for a national strategic stockpile are also gaining traction. As concerns mount over dependency on a geopolitical competitor, U.S. leadership is exploring avenues to ensure a stable domestic supply of these crucial materials.

Challenges Ahead for U.S. Miners

The challenges facing U.S. mining operations extend beyond market dynamics. A statement from Jervois Global’s Chief Executive Bryce Crocker highlighted a critical issue: “If the U.S. wants to have a stable source of domestic supply in the face of overwhelming market dominance from a geopolitical competitor, then it is going to have to intervene in some manner.” Given the complexities of obtaining financing for mining operations—especially in regions fraught with instability—the U.S. may need to rethink its investment strategies within this sector.

Understanding CMOC’s Business Model

CMOC’s business model is characterized by rapid decision-making and strong backing from Chinese state institutions, which enables it to navigate the complexities of international mining investments more efficiently than Western counterparts. As noted by Sun Ruiwen, CMOC’s chief executive, the company’s global expansion reflects China’s national ambitions, driven by state endorsement and strategic guidance.

Conclusion

As the global demand for cobalt continues to grow in tandem with the expanding EV market, CMOC’s dominance presents both risk and opportunity. The U.S. and its allies must consider how to fortify their positions in the cobalt supply chain, not only to mitigate risks associated with reliance on Chinese suppliers but also to support their own energy transition goals. The future landscape of cobalt will likely be influenced significantly by geopolitical maneuvers as well as market dynamics, making it a critical arena for investors.