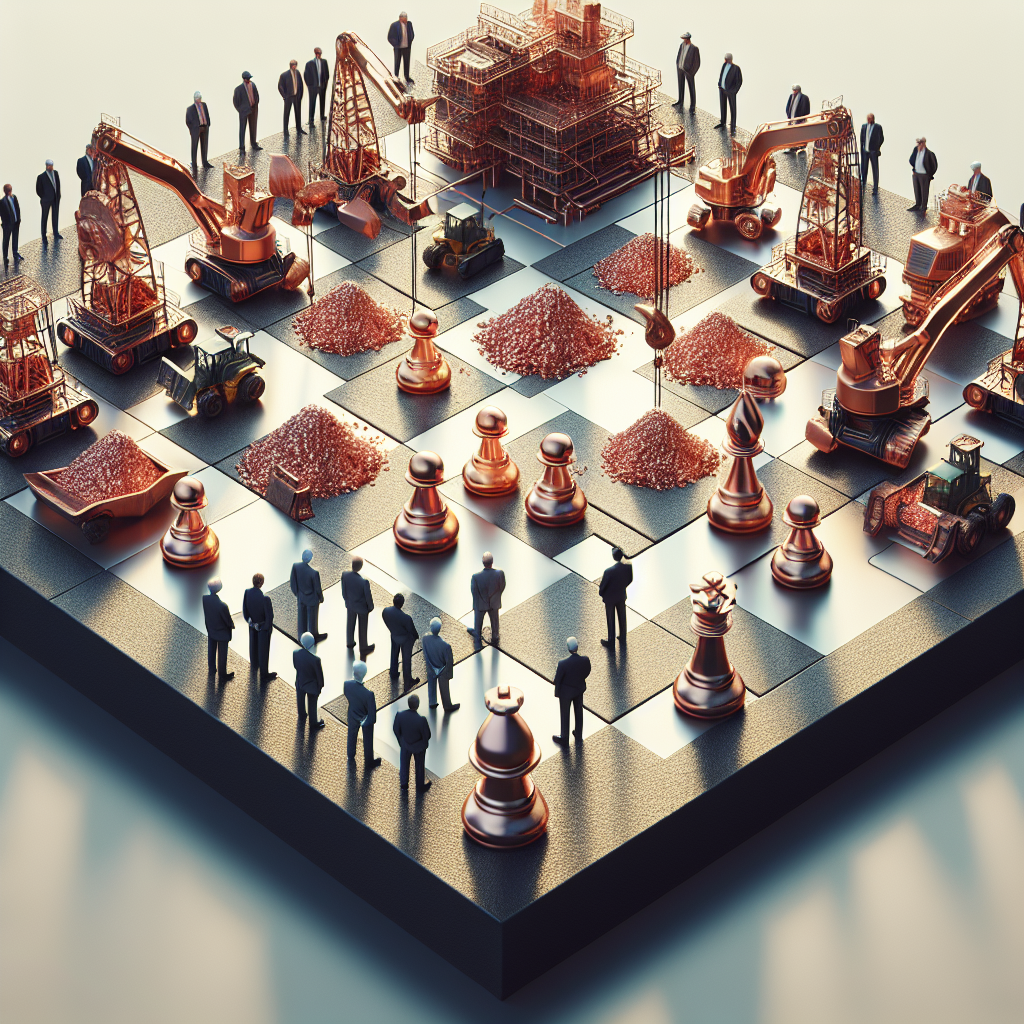

Rio Tinto Bets on U.S. Copper Mine amid Political Landscape Shift

In a robust maneuver that signals renewed optimism for the mining sector, Rio Tinto is positioning itself favorably for the anticipated green light from the Trump administration for its Resolution copper mine in Arizona. This move comes on the heels of a 12-year permitting struggle and aligns with broader expectations that President Trump will expedite the approval of significant domestic projects.

The Resolution Mine: A Potential Game-Changer

Rio Tinto CEO Jakob Stausholm expressed confidence in an interview, noting, “I do think that we have really good chances now to progress that project.” The Resolution mine, designed to be the largest copper mine in North America upon completion, stands as a testament to the increasing demand for domestic copper production. With construction anticipated to kick off if the necessary approvals are secured, the mine could yield up to 1 billion pounds of copper annually—essentially meeting 25% of U.S. demand.

Currently, Rio Tinto holds a 55% stake in the joint venture, with BHP owning the remaining 45%. This collaborative venture highlights the significant interest in the U.S. copper market, particularly as geopolitical dynamics prompt a reconsideration of resource import dependencies.

Regulatory Environment Under Trump

President Trump has previously made clear his intent to accelerate the regulatory approval processes for projects exceeding $1 billion in investments. The Resolution mine stands to benefit directly from these policies. As Stausholm points out, reducing reliance on imported critical minerals like copper aligns with national interests and could enhance U.S. resource sovereignty.

The intricate permitting process for the Resolution mine has been bogged down by various complications, including land ownership disputes, water usage issues, and opposition from local groups, notably the San Carlos Apache tribe. These obstacles inhibit not only the project timeline but also the market’s perception of the U.S. mining sector’s stability. The fate of the mine is now contingent on a ruling from the U.S. Supreme Court concerning the Apache tribe’s legal challenge, which asserts that the mine development infringes upon sacred Apache sites.

Looking Ahead: Favorable Conditions for Mining Investments

While the outcome of the Supreme Court’s decision looms, industry analysts are optimistic about the administration’s stance towards mining projects. Trump’s previous acts, particularly the regulatory approvals granted in the final days of his term, support the belief that the current administration may prioritize domestic mining developments.

Further reinforcing this sentiment is the potential approval of the Pebble Project in Alaska, owned by Northern Dynasty Minerals. This copper-gold project, like Resolution, is at the crossroads of environmental concerns and energy needs, reflecting the complex balance required in resource management today. Many industry executives believe that the Pebble Project is next in line for favorable outcomes from the newly appointed administration.

Assessment for Investors

For serious investors focusing on commodities and resource-driven stocks, the developments surrounding the Resolution mine and other potential projects serve as pivotal indicators of the mining industry’s future trajectory. As regulatory hurdles become more surmountable, the significant capital infusion into domestic projects could catalyze growth opportunities within the sector.

Investors should monitor the legal proceedings regarding the Resolution mine closely, as the Supreme Court’s decision may set broader precedents impacting other mining endeavors. Additionally, keeping an eye on the administration’s appointments, especially those tied to the Department of the Interior, will be crucial in gauging the political climate’s influence over mining regulations.

Conclusion

In summary, Rio Tinto’s bet on the Resolution copper mine reflects a strategic alignment with current U.S. political priorities. The expected regulatory facilitation could pave the way for significant advancements in mining projects across the country, benefiting the industry while addressing the U.S.’s critical mineral demands. As the market reacts to these developments, investors should remain vigilant and prepared to capitalize on the emerging opportunities in the mining sector.